DON’T MISS THE FOREST FOR THE TREES….

Therefore It is no surprise that we named our logistics company after a tree, the Bombax Ceiba (Red Silk Cotton tree). The Bombax tree is multi-dimensional and every part of it is useful. The roots are medicinal, the flowers are edible, the cotton fibres are woven to make fabric, the leaves have herbal properties, the trunk is strong, long and straight (and thorny to protect itself) and it is widely grown in India and Asia. It is also a beautiful tree (inside and out).

The Bombax tree is also our inspiration – to mould our company to not only provide sustenance and shelter (to our employees / customers / partners / vendors) but also to be useful to the ecosystem that we inhabit. It is a symbiotic relationship that we are grateful for.

As we begin our 6th year of operations, I can proudly state that “our Bombax” has taken firm root, grown into a strong adolescent, started to flower, has spread its “branches”, “weathered a few storms” and is now being appreciated for its efforts by the industry. This makes the entire Bombax family proud and humble!

As we look ahead to the below macro-economic factors that will affect us all, we gear up for the coming year with grit, determination, self-belief and hope:

Upward Trends:

Surface Infrastructure:

- The Union Budget 2023 has doubled the PM Gati Shakti National Master Plan to States from ₹5,000 crore ($ 625 million) to ₹10,000 crore ($1.250 billion), and has announced an outlay of ₹2.4 lakh crore ($30 billion) for the Indian Railways.

- The government has decided to increase its CAPEX investments by 68% to Rs. 1.9 lakh crores ($ 2.4 billion) to expand the existing road network by 25000 km.

- This is all part of the National Logistics Policy launched in September 2022.

Air Infrastructure:

- Airlines witnessed 520% increase in cargo revenue in last two years; 33 Domestic Cargo Terminals are planned under the GOI UDAN scheme by 2024-25.

- India’s Air Freight Market is estimated to be USD 13.08 billion in 2023 and is expected to reach USD 17.22 billion by 2028, growing at a CAGR of 5.65%.

- The CAPA-Centre for Aviation (India) has estimated that 1500-1700 new aircrafts will be ordered in the next 12-24 months as India remains “The most promising aviation market” due to the combination of strong demand and aggressive infrastructure development.

There is a concerted effort by the GOI to vastly improve India’s Logistics Performance Indicator from the current 42nd position in the next 3 years.

Challenges Faced:

Fragmentation:

- 85% of the industry is from the unorganized sector.

- 60% of goods moves by surface transport, highlighting the need for efficient ground logistics.

- 95% of domestic air cargo services are concentrated in the top 7 airports.

- Poor rural connectivity adds to time and handling and costs.

- Reverse logistics is expensive, inefficient and time-consuming (multi-segment).

Inflationary Pressures:

- High fuel prices and volatility put pressure on margins.

- Rising salaries and “yet to be introduced” labour reforms add costs to First Mile + Last Mile.

- Congestion, delays and increase in prices at cargo terminals makes the process slow and expensive – Index Rate for 2023 has been hiked to 7.27% for Private Cargo Terminals at major ports (highest escalation since it was introduced).

- Privatization of airports has increased efficiency but also increased prices for cargo handling (in some places as much as 3x).

Whilst the holistic GOI’s initiatives will bring about efficiency and drive down costs in due time, it is our focus to provide reliable supply chain solutions that can deliver high levels of efficiency in the short to mid-term. To that effect we have focussed on building out our supply-side pan-India network that connects regional airports (we now connect directly to over 22 airports) with rural distribution hubs (RDH) to execute express shipments that meet stringent TAT’s.

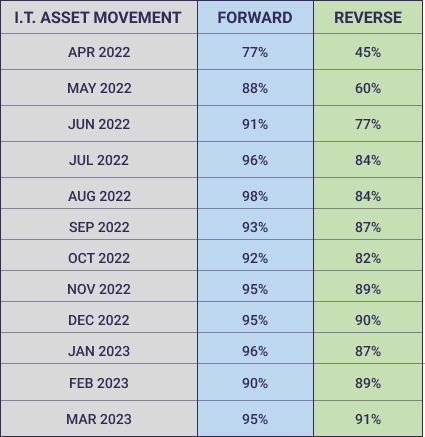

A snapshot of our performance matrix for I.T. Assets (Laptops / desktops / servers / monitors / accessories etc.) that we provide to our clients that consist of 3PL’s, OEM’s, Aggregators, MNC’s, Direct B2B etc. is below: