The boom & bane of logistics in india

The CAPA-Centre for Aviation (India) have estimated that 1500-1700 new aircrafts will be ordered in the next 12-24 months as India remains “The most promising aviation market” due to the combination of strong demand and aggressive infrastructure development.

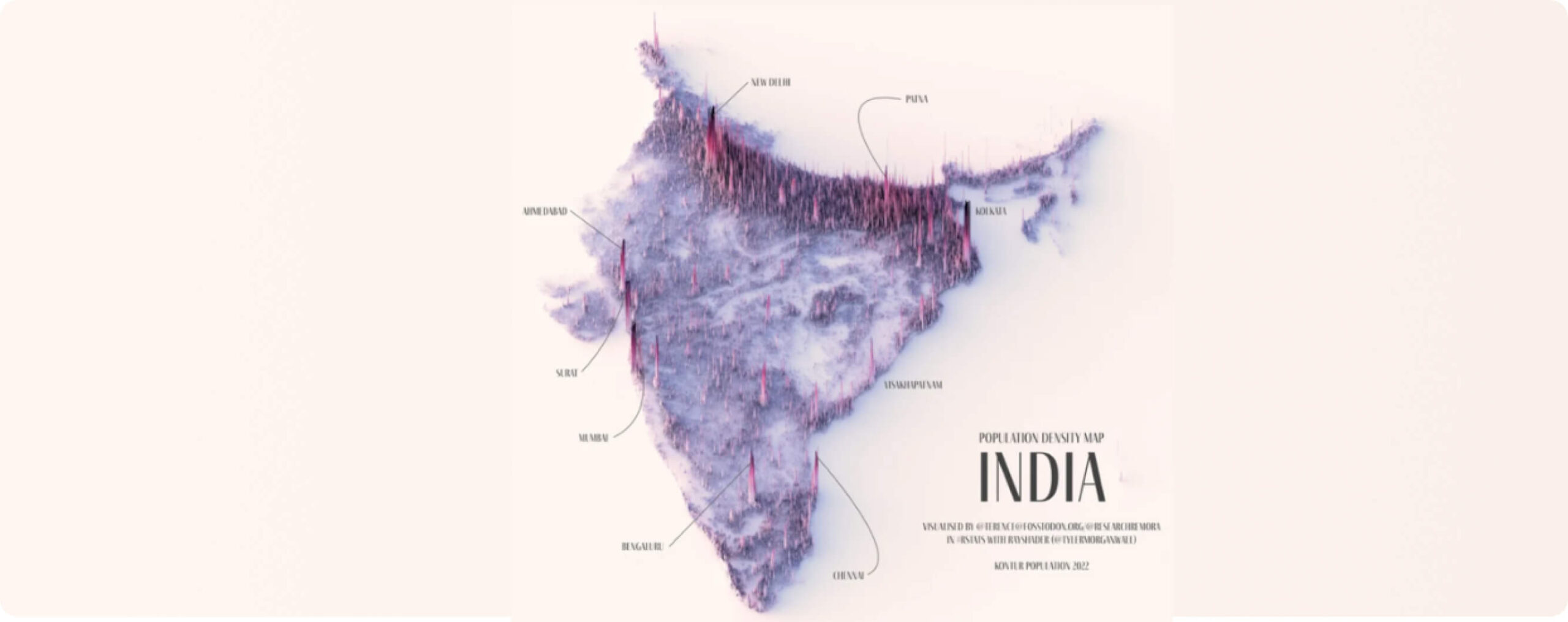

Despite these strong tail-winds air cargo movement in India is still fragmented and inefficient, underscoring the need for reliable domestic air cargo services. India is a vast country and is still very much a “developing nation” with developing infrastructure. Therefore, achieving logistic efficiency is a work-in-progress, which takes time. When we further analyze the supply chain gaps and look at the pattern of consumption demand (population density), it gives us a clearer understanding of why infrastructure development has been lagging in central India.

Whilst the GOI has identified this huge gap and is holistically addressing the infrastructure and integration issues with their initiatives such as Gati Shakti / UDAN / Bharatmala amongst many others, the supply-side constraints will certainly remain in the short to mid-term.

If we look at the map above and then conceptually ascertain the distances that need to be covered to connect demand & supply “from” and “to” these consumption regions, especially “from” the rest-of-India, we come to the same conclusion: that our current road line-hauls and air line-hauls are inadequate to achieve high levels of efficiency. The symptoms expose the problem, which are reiterated below:

Road Transport Inefficiencies:

Long distances, poor road conditions, low average speed, inadequate road-side facilities, unnecessary state border checks (police/ statutory agencies etc.), language barriers etc. Please see my previous article on this subject here: https://bombax.in/blog/logistics-inefficiencies-analysis

Air Transport Inefficiencies:

Whilst there are approximately 150 commercial airports, the top 7 Metro city airports handle almost 95% of the air cargo movement. This is a result of high demand in these areas but also a lack of adequate cargo facilities in the other airports (only 3 airports in India have 2 or more runways).

The combined result of the above 2 factors are:

- Road Line-Hauls are set plying on National highways (less than 5% of roads in India) leaving other lesser-developed (read rural) areas under-served, highlighting the critical role of expansive surface courier services

- Air Line-Hauls and are restricted to the 7 main airports (and then trucked from airport to the destination) which means that the rest-of-India cannot be catered to for express or time critical services.

This in turn leads to an increase in:

- Time consumed

- Handling charges

- Waste of resources to manage and track shipments across different modes and segments

- Number of Intermediaries required for fulfillment (from pick-up to final delivery)

Please see my previous article on this subject here: https://bombax.in/blog/logistics-challenges-solutions

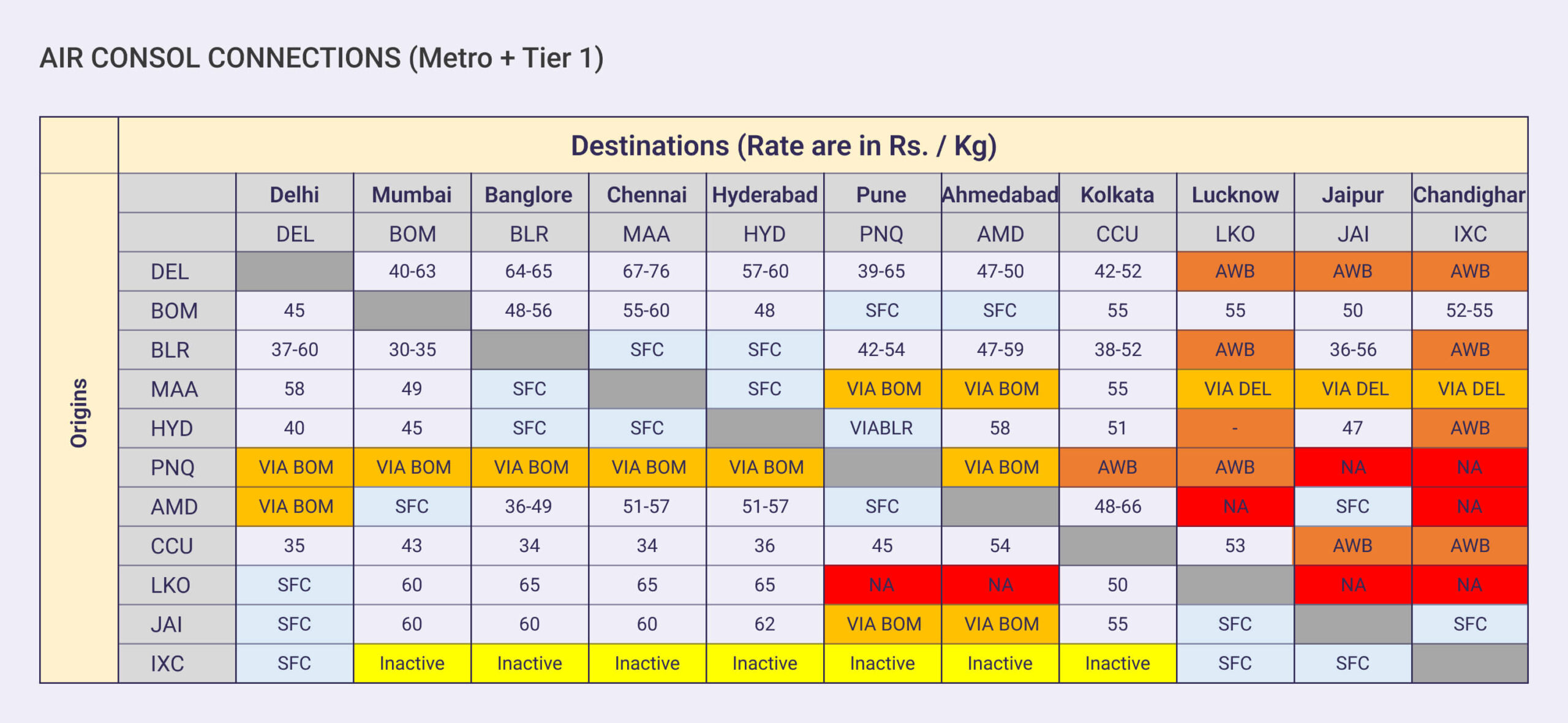

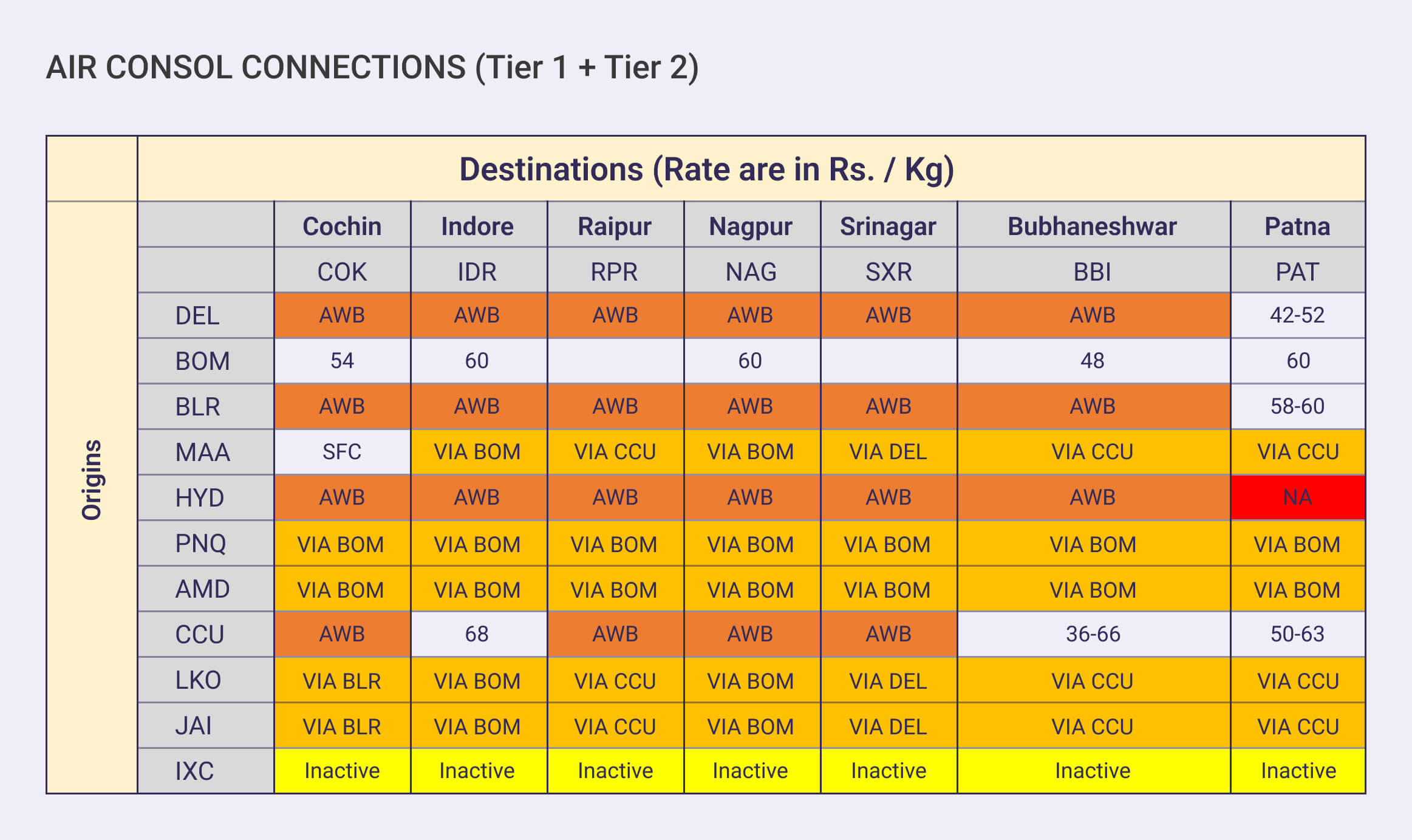

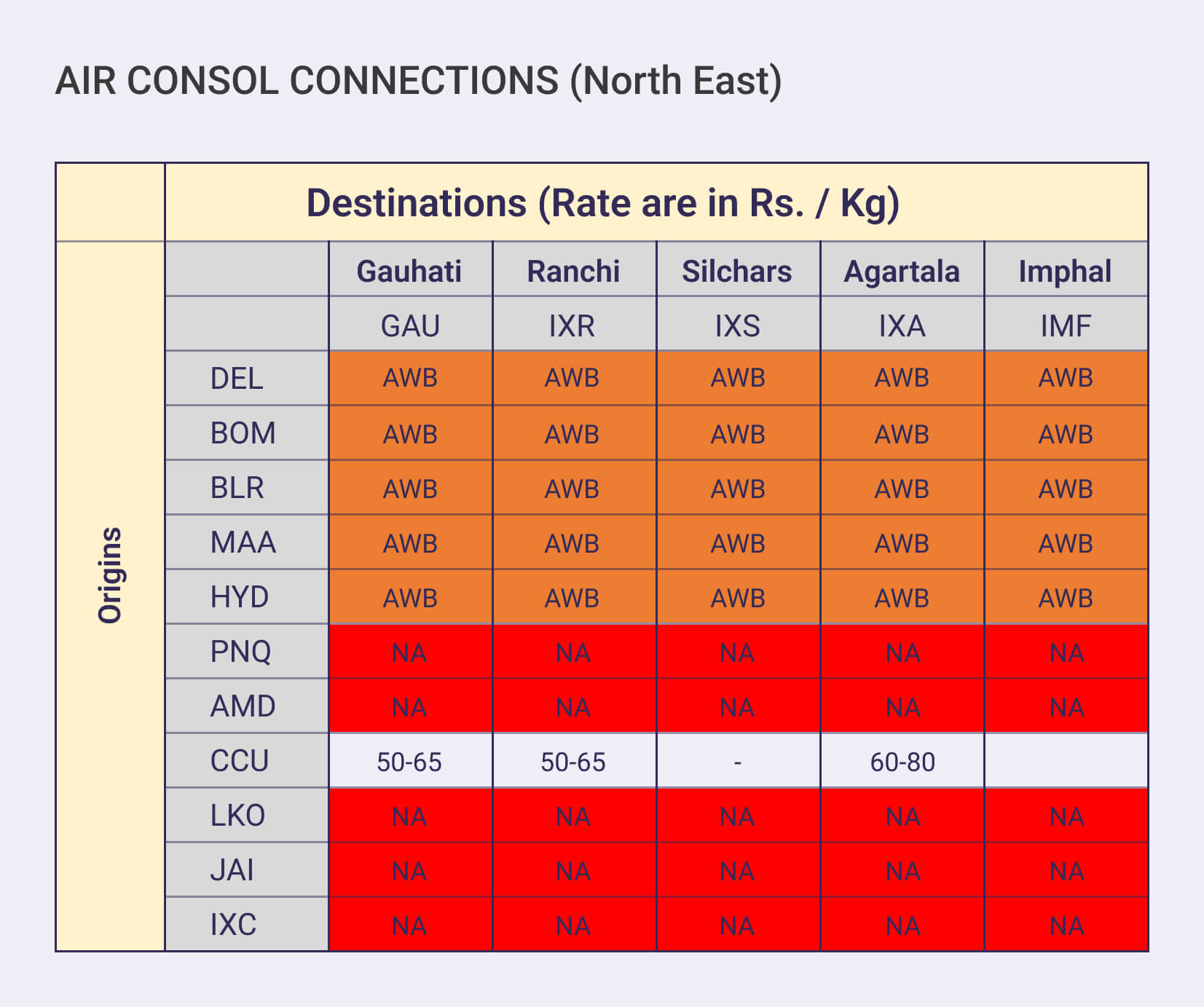

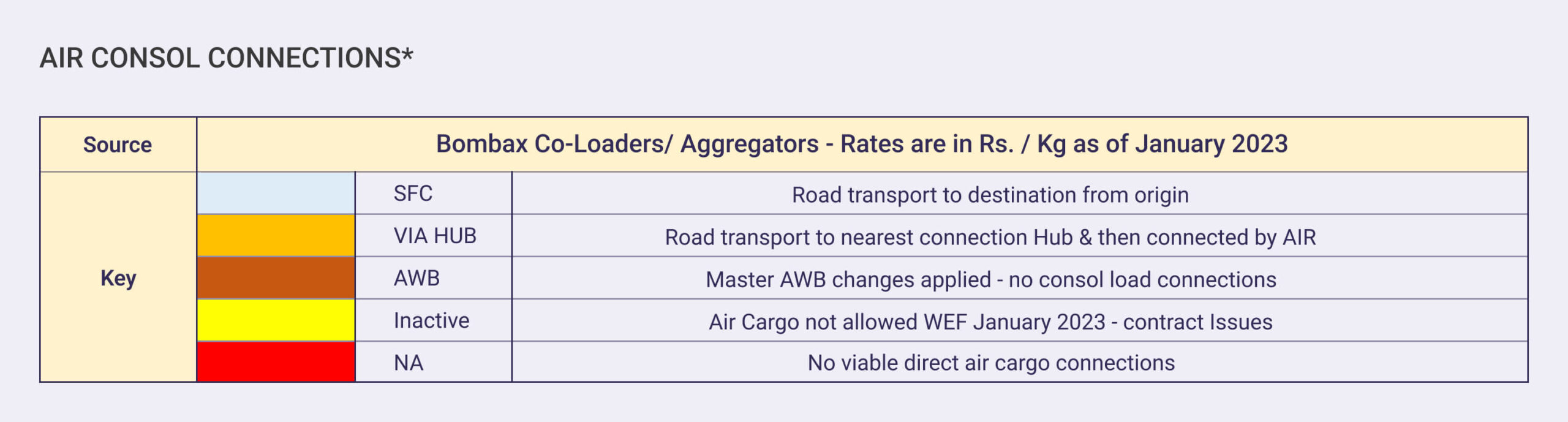

From our Bombax POV, we did an internal analysis of the various shipments that we send out on different modes depending on speed and importance – and present below a matrix of the possible air connections and costs associated with “express shipments”:

The matrix highlights the issues (caused by demand + supply as well as air-cargo infrastructure) for inter-city “express shipments” (that need to be delivered same day / next day). It is difficult to achieve high-levels of service in non-Metro cities due to these factors. This is primarily because only 8-10 air lanes offer regular consolidated load options (consol load means that cargo agents consolidate and aggregate load on one MAWB). Where consol load is not available, shippers need to purchase a separate AWB and then send their load on that, which is economically not viable.

Please see analysis of the air connection matrix below:

Please do reach out with your inputs and feedbacks, as we love to engage with our community and explore options of collaboration.